This week:

- Additional strain on truck capacity could see trucking prices rise after the closure of the Port of Baltimore

- Intermodal carriers prepare for the influx of Baltimore cargo, with railways planning new north-south services

- OSRA 2.0 receives criticism for not addressing shipper antitrust exemptions or rail demurrage grievances

- A new emissions report details the impact that Red Sea diversions may have on reaching IMO emission reduction goals

Mid-Atlantic Trucking Faces Unexpected Obstacles from Baltimore Port Closure

On March 21, the US House of Representatives passed the latest amendment to the Ocean Shipping Reform Act 2022 (OSRA-22) to protect shippers and US industry from the Chinese Government’s influence while improving shipping transparency.

Referred to as OSRA 2.0, the Ocean Shipping Reform Implementation Act gives the Federal Maritime Commission (FMC) more authority over controlled carriers. Previously, the definition of a controlled carrier was one that received support from a foreign government. Under the new act, a controlled carrier would also refer to shipping lines under the control of a nonmarket economy country or any countries under US investigation for anticompetitive practices.

US shippers will also be able to report shipping exchange market manipulation. At the same time, US terminal operators will be barred from using Chinese-developed LOGINK software currently installed on ship-to-shore cranes.

In addition to these changes, OSRA 2.0 will require the FMC to establish new data standard rules for maritime freight logistics along with new committees allowing carriers and terminals to advise the FMC moving forward.

Subscribe to JMR’s Weekly Supply Chain Roundup!

Stay informed with the latest supply chain news, trends, and insights. Get it delivered directly to your inbox every week.

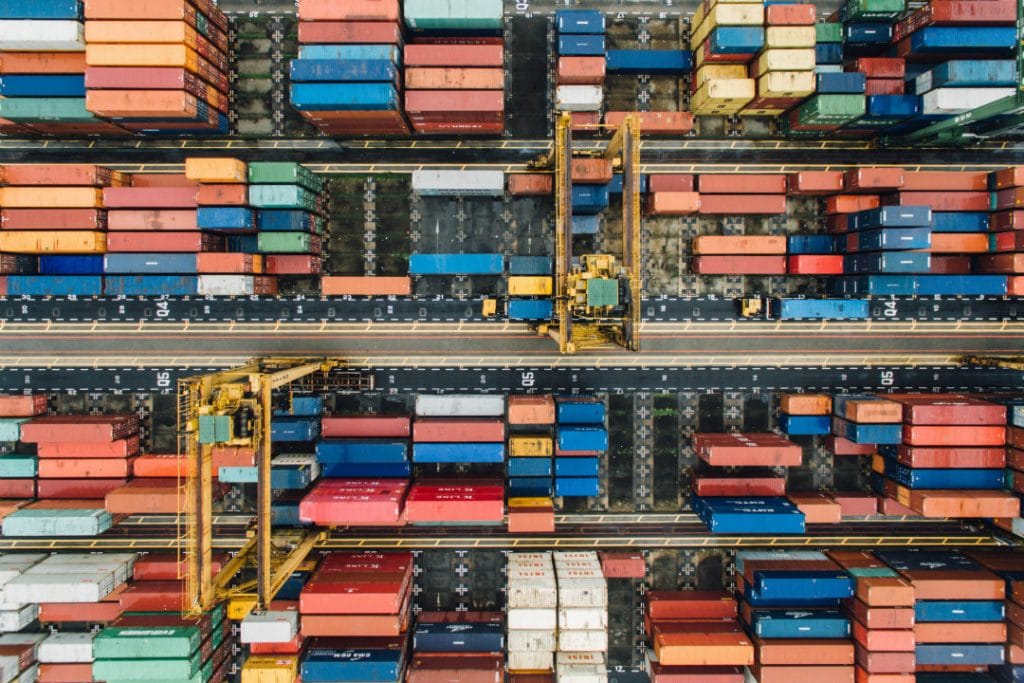

US North-East Ports and Intermodal Carriers Prepare for Influx of Baltimore-Bound Cargo

As ocean carriers reroute ships to other ports after the closure of the Port of Baltimore, intermodal provider CSX Transportation has announced plans for new North-South trips to transport cargo between alternative ports. The Port of Baltimore’s largest container terminal, Seagirt Terminal, had 18 vessels scheduled to arrive through April 6. Three Mediterranean Shipping Co. vessels will now be arriving at the Port of Philadelphia, and another seven ships will be rerouted to Port Newark Container Terminal in New Jersey.

Other Baltimore-bound vessels are now scheduled to arrive at the Port of Virginia, and some carriers, such as CMA CGM and Evergreen Marine, have declared force majeure for some vessels, not announcing where they will unload cargo.

For cargo owners with a preference for access to Baltimore, Seagirt Terminal’s operator Ports America is currently in talks with CSX Transportation regarding moving diverted containers to Seagirt’s intermodal container transfer facility. Norfolk Southern railway is also considering a similar service. Exporters using the Port of Baltimore have also been affected, with CMA CGM sending a notice to shippers that their laden export containers can remain at the port until its reopening, but that the repositioning of containers would be at the shipper’s expense.

OSRA 2.0 Skips Over Shipping Antitrust Exemption and Unfair Rail Demurrage

The Ocean Shipping Reform Implementation Act, dubbed OSRA 2.0, was passed by the US House of Representatives on March 21 to amend aspects of the landmark Ocean Shipping Reform Act of 2022 (OSRA-22) bill. However, critics are now pointing out that OSRA 2.0’s focus has changed to improving US scrutiny of the Chinese government’s influence over US and international shipping, instead of making technical corrections to OSRA-22.

One missing component from OSRA 2.0 is the clarification of which federal agency is responsible for regulating rail storage fees when ocean carriers are responsible for the final delivery of cargo. Shippers and consignees wishing to contest what they believe are unfair rail and demurrage charges currently have no government recourse. Due to an exemption for intermodal services from the US Surface Transportation Board, it is still unclear which agency should bear regulatory responsibility, although representatives are working on an additional bill to provide clarity on the matter.

A second component absent from the bill is any repeal of limited antitrust immunity for carriers after the Federal Maritime Commission’s (FMC’s) Mark Vekich and Carl Bentzel, both FMC commissioners, suggested that the FMC be given the power to legally block anti-competitive working agreements between ocean carriers, instead of leaving this power with the courts.

Report Shows Red Sea Diversions are Driving Shipping Emissions Dangerously High

The 2024 Container Shipping Outlook Report published by AlixPartners and released on March 25 has provided predictions on the impact of the Red Sea shipping diversions around the Cape of Good Hope. Last year, the container shipping industry’s emissions totaled approximately 230 million tons, accounting for almost a quarter of the emissions of all maritime shipping.

Numerous changes have been enacted throughout the industry to meet the International Maritime Organization’s (IMO’s) emissions targets, such as reduced vessel speeds and changes to permissible fuels used by ocean carriers. However, 2024 will see a spike in emissions, rather than following the decreasing trend towards the targeted 20% reduction by 2030 and net-zero by 2050 goal.

The increase is attributed to the Red Sea diversions, which have forced vessels on the Asia-US East Coast, Mediterranean, and Asia-Northern Europe lanes to extend voyages by an average of 30%.

Although the AlixPartners report showed that the 2030 goal may not be achievable in light of the increased emissions from the longer voyages seen this year, it also stated that the 2050 emissions reduction goal set out by the IMO may still be within reach. For the industry to meet this goal, however, 5% to 17% of the entire industry’s vessels would need to be converted to zero-emission fuels by 2030, with 84% to 93% converted by 2050.

(Source: Richard Alexander | Pixabay)