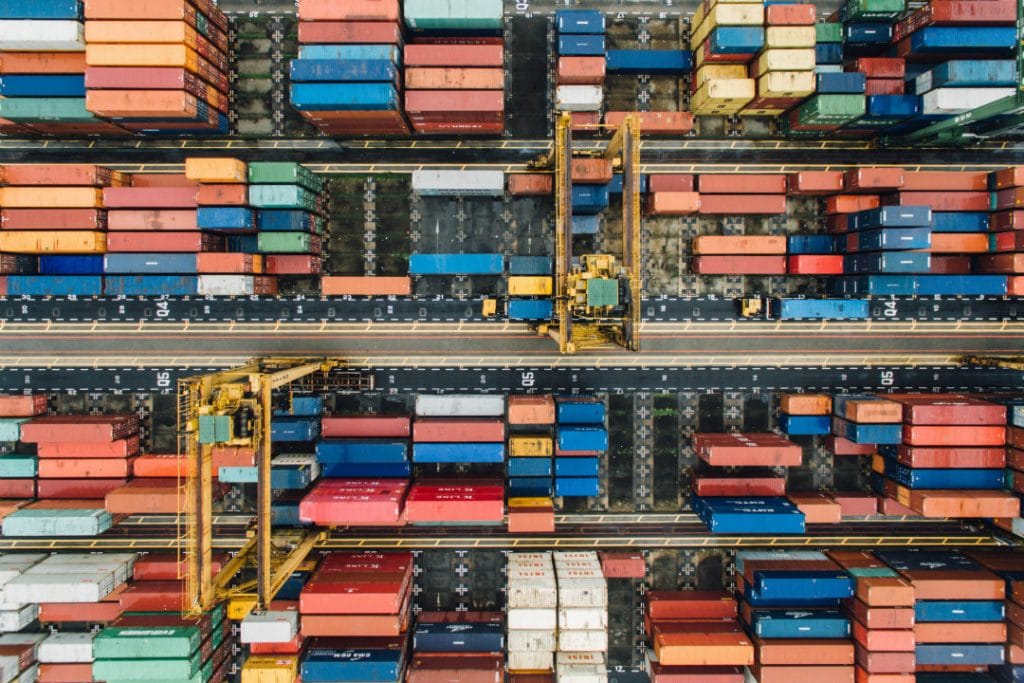

Rail, Truck Container Dwells at LA-LB Ports Hit Low Point as Peak Season Hits Early

The LA-LB ports are coming off a boom in activity following the ratification of a new labor agreement in 2023. Post-pandemic recovery at the ports saw increased cargo volumes, particularly in the last quarter of the year and early 2024.

Both ports invested in infrastructure improvements during the year, focusing on rail projects. Long Beach has completed several rail projects and is expected to start constructing Pier B’s on-dock rail facility. LA’s port is also undertaking several rail improvements and investments in green initiatives.

Industry observers expect this year’s import peak season to begin in June as retailers restock merchandise inventories for the summer. Other factors moving up this year’s peak season are strong demand for eCommerce shipments and concerns around a potential strike by the International Longshoremen’s Association (ILA).

The declining dwell times arrived as railways BNSF and Union Pacific provided extra equipment to move import inland point intermodal containers from the docks.

Subscribe to JMR’s Weekly Supply Chain Roundup!

Stay informed with the latest supply chain news, trends, and insights. Get it delivered directly to your inbox every week.

South Carolina Ports Authority Begins Recovery After Software Glitch

The problem was first detected on Sunday, May 19. Soon after, SC Ports was forced to close the Charleston port and inland harbors. The closures remained in place for the bulk of two days. SC Ports later attributed the problem to a “technical issue” with its port management software. An attack on the port authority’s technology infrastructure was ruled out.

In a statement issued late Tuesday, May 21. SC Ports said cargo pickups and drop-offs had resumed at all marine terminals. Inland Port Greer was also said to be operational, but other busy inland ports — including Inland Port Dillon — remained closed.

By Friday, May 24, SC Ports announced all operations had returned to normal. To speed up the recovery process, the port authority extended gates hours, with the Wando Welch and North Charleston Terminals set to open at 3 am for a few days.

Shipping Container Shortages Plague Asian Carriers and Shippers

Strong market demand, exacerbated by lower vessel capacity due to the ongoing disruption caused by Houthi rebel attacks in the Red Sea, has depleted container availability across major Chinese ports. The shortage extends to numerous Chinese ports, impacting major carriers like Maersk, Hapag-Lloyd, Cosco, HMM, and MSC. Xiamen remains an exception, with the logistics company reporting sufficient containers.

While logistics experts have warned of container shortages for months, the situation has proven more challenging than expected. Carriers skip ports, implement premium rates, and even cancel sailings to manage the increased demand. This is causing delays and higher costs for all shipping activities and contributing to the shortages.

Industry Analysts Struggle to Forecast the Rest of 2024

Monthly average container freight rates fluctuated wildly between January 2023 and March 2024. They dipped to their lowest point on October 26 of last year, when the going rate for a 40-foot container was US$1,342. By February 2024, the average rate was around US$3,900.

Jensen notes that re-establishing safety in the Red Sea is critical to determining the short-term future of container shipping. The attacks forced many vessels around the Cape of Good Hope to reroute, increasing transit times and costs. This placed additional strain on an already stressed supply chain, contributing to delays and higher freight rates.

At the same time, other industry observers note a wave of new vessel deliveries, exacerbating overcapacity concerns. This surge in capacity has put downward pressure on freight rates. Still, many see reason for optimism. The post-pandemic easing of port congestion and the gradual normalization of supply chains are expected to continue, delivering a much-need sense of normalcy.

For their part, carriers and shippers are focusing on optimizing operations, exploring new technologies, and diversifying their networks to mitigate risks and capitalize on emerging trends, like the increase in eCommerce demand. The one thing that seems clear to all analysts is that adaptability is the key to weathering the ups and downs of market conditions.