This week:

- The Port of Baltimore set to reopen; import bookings rebound in response

- Federal agencies and shipping carriers map out Port of Baltimore recovery plans

- Importers booking “as much cargo as possible,” thanks to favorable Trans-Pac spot market contracts

- Continued ocean trade lane disruptions lead to a strong 2024 for air cargo

- LTL carriers purchase new trucks and trailers, expand networks

- Continued global port congestion leads to delays and logistical headaches

Baltimore Shipping Port Set to Reopen as Import Bookings Rebound

The Port of Baltimore’s Seagirt Marine terminal was tentatively set to reopen on Monday, June 10. This follows months of closure due to the Dali cargo ship’s collision with the Francis Scott Key Bridge. The accident caused extensive debris, hindering access to Baltimore’s main shipping channel. News of the planned reopening led to a sharp rebound in import bookings, expected to increase over the summer.

The US Coast Guard and port officials had targeted a complete restoration of port activities earlier this month. However, recent surveys revealed the need for additional dredging. The Dali has been relocated to Virginia for debris removal and repairs.

Subscribe to JMR’s Weekly Supply Chain Roundup!

Stay informed with the latest supply chain news, trends, and insights. Get it delivered directly to your inbox every week.

Federal Agencies, Shipping Carriers Plan Baltimore Port Recovery

The White House Supply Chain Task Force recently convened to address potential bottlenecks at the port. Agencies like the Department of Agriculture and the Department of Commerce are working with stakeholders to ensure a full recovery of Baltimore-bound cargo.

Meanwhile, carriers like MSC, Hapag-Lloyd, ONE Line, and OOCL all recently announced plans to resume full operations or accept future bookings for the port. However, Maersk announced it was suspending its TP20 Asia-US East Coast service to reallocate the TP20’s capacity elsewhere in its network. The TP20 had lately been operating on a scaled-back port rotation of Shanghai-Yantian-New York-Baltimore-Houston.

According to observers, the return to full capacity at the Port of Baltimore will be gradual. For the next few months, some shipments will still be redirected to other ports.

Trans-Pac Spot Market Surges as Importers Book “as Much Cargo as Possible”

Analysts expect demand to remain strong as imports from Asia reach high levels. An ocean carrier executive who spoke to the JoC on the condition of anonymity said importers are booking as much cargo as possible under the allotments in the newly inked service contracts. Many of the advantageous rates went into effect on May 1, causing the demand surge that remains strong one month later.

Ocean Shipping Disruptions Put Air Cargo on Track for a Strong 2024

Analysts expect demand to remain strong, even as detours and delays in the Red Sea continue to decline. While air freight rates haven’t reached the peak levels seen during the pandemic, a narrowing price difference with ocean freight indicates a strong 2024 for air cargo.

eCommerce shipments from Asia continue to drive increased air freight volume. While industry observers expect demand in this sector to remain strong, shippers and forwarders currently favor shorter-term contracts as ocean trade routes stabilize.

US Less-Than-Truckload Carriers Purchase New Trucks, Expand Network

The Illinois-based LTL carrier Roadrunner recently expanded its network by acquiring and refurbishing a former YRC Freight terminal in Atlanta. This will enable Roadrunner to expand its presence into more than 40 US metro markets. Roadrunner chose the Atlanta location for its proximity to major interstates. New trucks and trailers will help the carrier service the increased demand.

Knight-Swift Transportation Holdings announced in April that it will have opened 32 new LTL terminals by the end of 2024. That includes 24 facilities Knight-Swift acquired from the defunct LTL provider Yellow. Seven of those facilities were opened in Q1 2024, helping to expand Knight-Swift’s growing regional network.

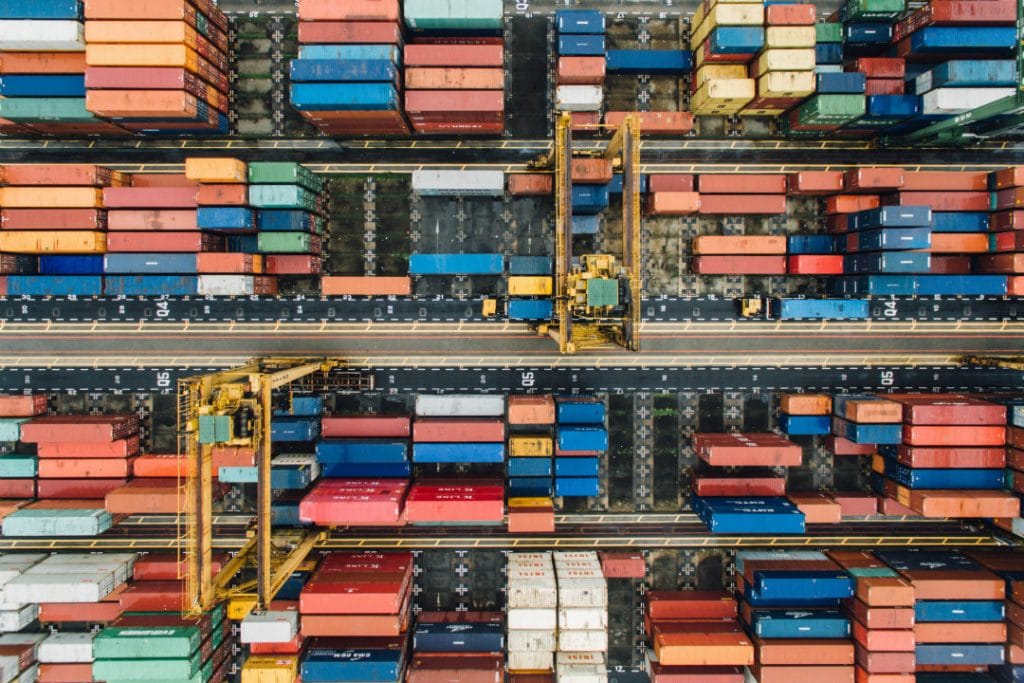

Global Port Congestion Still Causing Delays as Capacity Worsens

Unless the Red Sea crisis ends or demand slows, industry experts predict delays and congestion will continue throughout the summer.

The global container fleet is expected to reach 30 million TEUs in June. According to Fabio Santucci, president of Mediterranean Shipping Co.’s US operations, port congestion ties up between six and seven percent of that capacity.

Source: cegoh | Pixabay