This week:

- The Port of New York and New Jersey is expected to significantly increase its number of cranes that have the ability to handle ultra-large container ships.

- Norfolk Southern Railway announced in early October that it would accept more ocean containers at its Midwest terminals for loads traveling to the West Coast.

- Rail container dwells have been increasing at the ports of Los Angeles, Long Beach and in the Pacific Northwest, due to a shortage of rail cars.

- The Port of Savannah is currently dealing with a backlog of vessels after a series of brief closures.

- U.S. imports are expected to decrease in volume, as retailers are stocked for the holiday season.

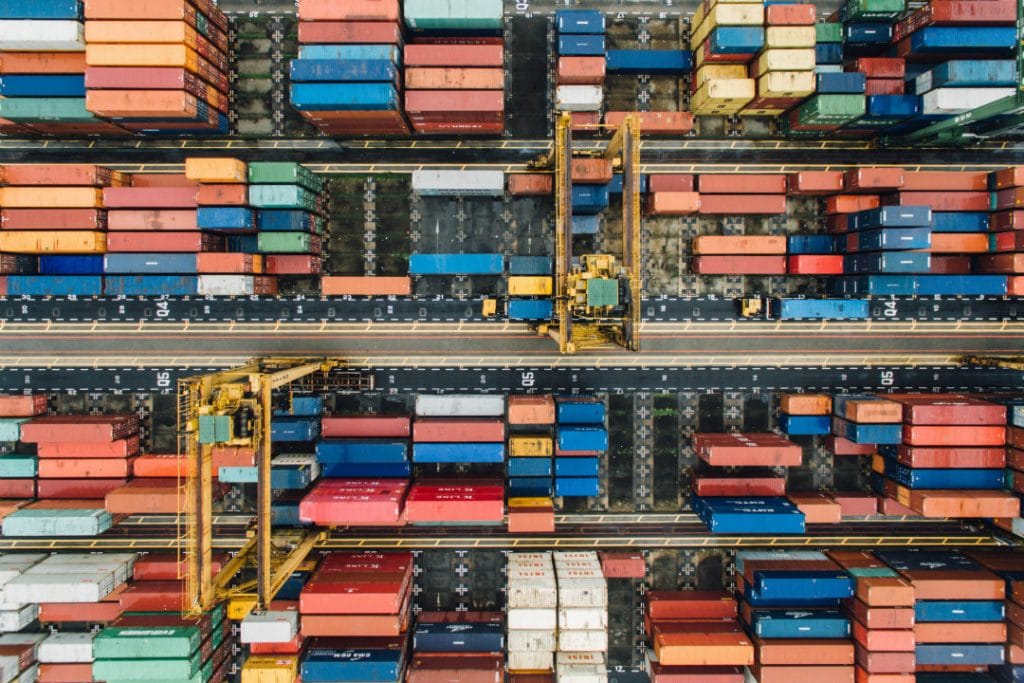

New Cranes To Increase NY-NJ Port’s Ability To Handle Ultra-Large Ships

According to reporting by the Journal of Commerce, the port is scheduled to add 12 more cranes that support ultra-large container ships to the 28 super-post-Panamax cranes that are already in place at the port’s largest marine terminals.

The move is in anticipation of an increase in large vessels from India and Southeast Asia in upcoming years.

The new generation of cranes allows the port to work ships up to 10 containers high and 23 containers across.

Sign up to Receive JMR’s Supply Chain News Roundup, Delivered Directly to Your Inbox Weekly

Norfolk Southern Railway Announces Operational Changes

The railroad, which is prominent throughout the eastern side of the U.S., is now taking on ocean containers traveling west at Cincinnati, Cleveland, Detroit and Louisville, whenever those terminals are open.

The operational shift from Norfolk Southern Railway is seen as a move to increase its commitment to shippers.

West Coast Rail Dwells Continue To Rise

While rail dwells have been an issue on the West Coast since early summer, the problem became worse in September, according to reporting by the Journal of Commerce.

But, according to industry leaders, it has not caused major disruptions, because of modest import volumes.

According to The Pacific Merchant Shipping Association, dwells in August were 4.45 days, which is up from 4.14 days in July and four days in June. September data is not yet available.

“We had some inventory buildup the last two to three weeks,” Alan McCorkle, CEO of Yusen Terminals in Los Angeles, told the Journal of Commerce. “[The railroads] are not positioning enough bare tables here.”

Unexpected Backlog Lingering In Savannah

In late August, the arrival of crane equipment at Savannah’s Garden City Terminal temporarily shut down two berths, so some cargo could not be removed from specialized vessels. A week later, Savannah’s shipping channels were shut down for two days due to Hurricane Idalia. The hurricane did no damage to the port, but it slowed down logistics.

Tom Boyd, spokesperson for Georgia Ports Authority (GPA), told the Journal of Commerce that he expects operations to be back to normal by the middle of November.

“The current situation requires aggressive significant catch-up efforts over the next several weeks,” Boyd said. “GPA is doing just that to expedite the vessel queue as quickly as possible.”

U.S. Retailers Expect Import Slowdown

The new monthly report from the National Retail Federation and Hackett Associates shows October imports declining 3.1% year over year, after there was a 0.1% year over year gain last month. November imports are projected to increase 7.5% from November 2022, but that is down from an earlier 10.4% projected increase.

Jonathan Gold, vice president for supply chain and customs policy at the NRF, said in the report that retailers stocked up for the holidays early this year.

“Cargo volumes will be strong the rest of the year, but not as high as we expected a month ago,” Gold said.

Since the beginning of the year, actual containerized imports from Asia have fallen 21.2% year over year.

“We are already seeing this in the operational decisions carriers are making,” Ben Hackett, founder of Hackett Associates, said. “They have slowed down their ships in an attempt to cut capacity without having to take vessels out of service as new, larger ones ordered when demand was higher are delivered. Even so, ships are not sailing fully loaded and freight rates are declining as a result.”