Congestion in US Ports Still Not Remedied by Slower Import Growth

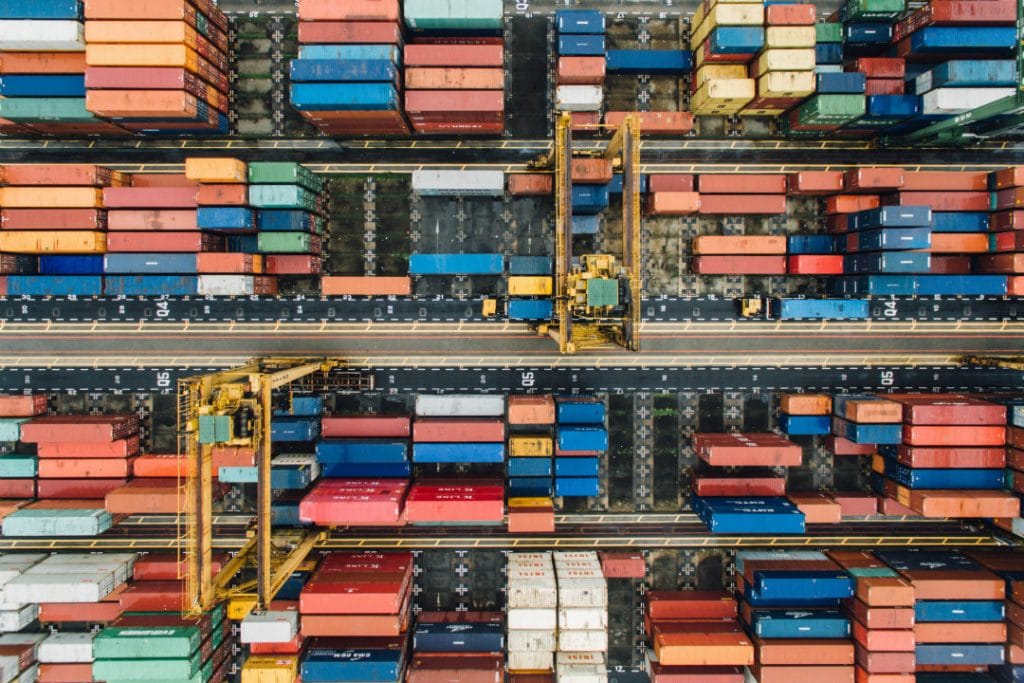

US imports in the first half of this year will likely grow at a much more modest rate than the same period in 2021, with projections indicating an increase of 1.5 percent in US imports. This is good news for retailers and supply chain professionals, who have struggled with the turbulence of 2020 and 2021 caused by the COVID-19 pandemic. However, it likely won’t be enough to clear the cargo backlog that has built up from the previous year’s historic volumes of imports.

For comparison, imports increased by an astounding 35.7 percent in the first half of 2021 compared with the same period in 2020 as import numbers initially slumped in 2020 and then quickly bounced back in 2021. The sharp increase in imports during 2021 caused ports around the nation to develop large backlogs, the effects of which are still felt a year later.

According to NRF’s Global Port Tracker projections, February will see an 8.7 percent increase in imports compared to the previous year, partly due to the pre-Lunar New Year rush, while March is expected to drop 6.7 percent compared to last year.

Although import numbers remain high off the back of 2021, a steady and modest increase over 2022 means supply chains will have some breathing space to continue adapting to historic rises in demand.

LTL Carriers Pulled Closer to Major Ports Due to Increased Transload Demand

Over the past two years, the increase in international imports has driven demand for less-than-truckload (LTL) carriers to play a crucial role in transporting international freight from backlogged ports and warehouses to inland distribution networks.

Although traditionally focused on domestic freight, LTL carriers are now one of a limited number of options for transporting international cargo away from ports, as truck and rail options are already at capacity. The solution that LTL carriers provide for the current freight bottleneck is to transport containers to an LTL terminal for deconsolidation, where goods are then transported as LTL shipments to customer distribution centers, a process referred to as transloading.

Transloading infrastructure, such as deconsolidation facilities, is currently lagging behind the surge in demand, with some IPI containers being transported 250 miles inland for deconsolidation before being returned. Because the distance between ports and many LTL facilities makes LTL carriers an expensive option, the urgent need to move cargo inland from ports continues to increase demand for more LTL carriers and the construction of transloading facilities closer to ports.

Consumer behavior has also bolstered demand for transloading and LTL services. Previously, LTL carriers focused on shipping industrial freight. However, consumers are purchasing more oversized items online, such as appliances, that are too big for regular parcel delivery services. Changing consumer behavior also means freight is moving in smaller international shipments, making LTL carriers an increasingly effective transport option.

By deconsolidating containers near ports, LTL carriers can seamlessly transition between the first inland mile and “middle-mile” distribution to distribution centers, stores and eCommerce fulfillment centers. Some LTL carriers provide direct-to-consumer services, taking freight from the ports directly to customers and changing the way the nation’s supply chains function now and into the future.

Progress Continues on US Regulatory Legislation on Container Shipping

The US Federal Maritime Commission (FMC) has launched investigations over the last five months into the detention and demurrage billing practices of three container liners after shippers made several accusations of illegal behavior. Price gauging throughout the COVID-19 pandemic and additional billing of shippers has played no small part in the industry’s 2021 annual profits reaching record levels. By the end of 2022, HSBC expects the container line industry to reach $163 billion in operating profit, more than 32 times the $5 billion annual profit the entire industry made only two years ago in 2019.

The FMC’s investigations focused on shipping companies Ocean Network Express, Hapag-Lloyd and Wan Hai, highlighting aspects of the shipping industry that are the target of a fast-moving piece of legislation known as the Ocean Shipping Reform Act (OSRA) 2021. If passed, OSRA 2021 will require container companies to validate detention and demurrage charges.

The current House bill and Senate draft requires carriers and marine terminals to ensure that storage fees meet shipping law to encourage fluid and uninterrupted cargo movement.

If the signed version of the bill requires container lines to certify all storage fees, container lines will no longer be able to bill shippers and consignees for detention and demurrage.

The OSRA 2021 bill will also create more scrutiny and restrictions for container liners regarding their common carriage responsibilities. The House bill will prohibit container lines from declining export bookings if the cargo can be loaded safely and on time. The Senate bill will prohibit discrimination based on cargo type. Both bills call on the FMC to create rules outlining when a carrier can refuse service.

Anchored Vessels in Charleston Projected to Be Cleared by Mid-March

Like many ports throughout the US, Charleston Port in South Carolina is still dealing with a backlog of almost 20 vessels anchored outside its harbor waiting for a space to unload. With terminal congestion moving in a positive trend, the South Carolina Ports Authority believes that another six weeks is needed to clear the current backlog of containers and work down the queue of 19 vessels currently waiting as of the 9th of February.

The current seven-day wait for vessels is largely caused by empty containers that are left waiting at the terminal, taking up valuable space that could be used for new containers to be processed. On the 9th, as many as 7,400 containers had been on the terminal for over 15 days, peaking at 8,500 containers just a week before.

Pre-pandemic, the average container dwell-on time was four days; however, that number currently sits around the 10-day mark. Other East Coast ports face the same problem, with New York and New Jersey having between five and 10 vessels waiting off-shore as of the 9th of February, while the Port of Savannah just finished processing its backlog at the start of the month.

To help clear the backlog, Charleston Port is giving higher berthing priority to vessels that take more containers than they drop off to speed up removal. Now that more space has been made available in the port’s terminals, Charleston Port has also begun using four cranes per vessel. Pre-pandemic, the port typically used five cranes per vessel. However, to conserve space in the port, they reduced that number to three.